In 2026, the financial world is no longer just about Wall Street; it’s about “Generative Wealth.” With Artificial Intelligence (AI) handling everything from real-time tax-loss harvesting to 24/7 market monitoring, the question isn’t if AI will change financial planning, but if the human advisor is now obsolete.

The Pros: Efficiency and Precision

AI’s primary advantage lies in its ability to process data at a scale impossible for humans.

- Hyper-Personalization: Algorithms can analyze millions of data points in microseconds to rebalance portfolios in real-time. Accenture estimates that early adopters of these tools see productivity gains of 22% to 30%.

- Accessibility: Traditional advisors often require minimum balances and charge fees around 1% of assets. AI “robo-advisors” democratize high-level strategies, providing 24/7 market monitoring and tax-loss harvesting for a fraction of the cost.

- Pattern Recognition: AI excels at identifying subtle market shifts and executing trades without the psychological biases, that often lead human investors to panic during volatility.

The Cons: The Empathy Deficit

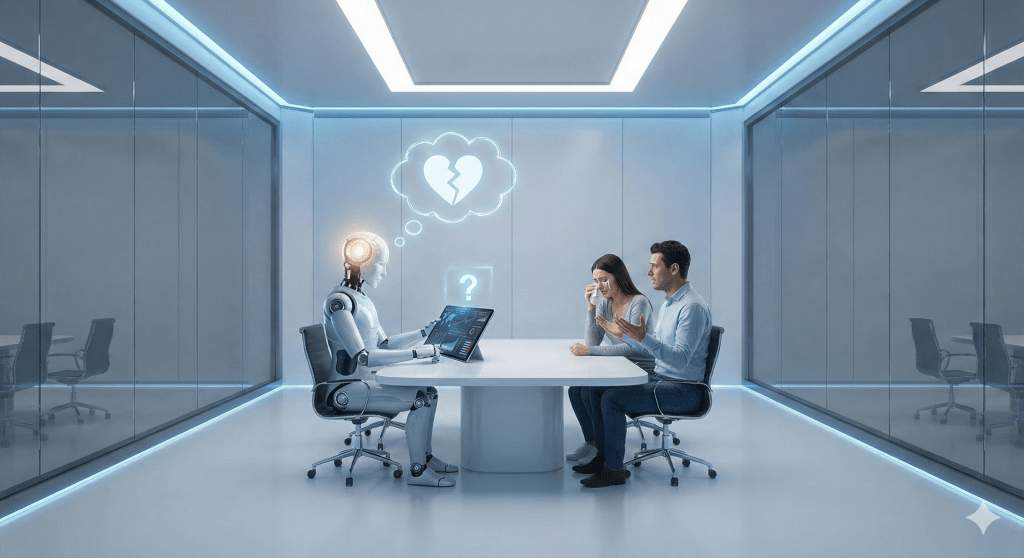

Despite technical prowess, AI remains limited by its lack of Emotional Intelligence (EQ).

- Contextual Blindness: While AI handles the math, it often fails to understand the “why.” It cannot navigate the emotional nuances of saving for a child’s education or the psychological comfort needed during a 30% market correction.

- Complex Life Events: Machines struggle with “gray area” scenarios such as divorce settlements, family succession planning, or ethical investing preferences that do not fit a standard data model.

The Risks: Hallucinations and Regulation

The most significant risks in 2026 involve accuracy and legal protection.

- Error Rates: A Money Magazine test found that AI correctly answered financial queries only 65% of the time, with many responses being incomplete or misleading regarding tax laws.

- Regulatory Gaps: In many jurisdictions, AI-only advice lacks the safety net of the Financial Services Compensation Scheme (FSCS) or the Financial Conduct Authority (FCA) oversight. If a bot provides flawed advice leading to catastrophic loss, users often have no legal recourse.

The 2026 Reality: The Hybrid Model

The industry has converged on a “CoBot” (Collaborative Robot) model. In this hybrid setup, AI handles the heavy lifting of data analysis and routine reporting, while human advisors provide the strategic vision, ethical judgment, and “financial therapy” that machines cannot replicate.

Generative AI is not going to rewrite the fundamental business, but is going to change how that business gets done.