Geopolitical events often feel distant—something that happens on the news rather than in our day-to-day lives. But history shows that wars and conflicts, especially in energy-producing regions, have direct and measurable effects on household finances. A potential attack involving Venezuela is no exception.

1. What History Tells Us: Wars and Oil Prices

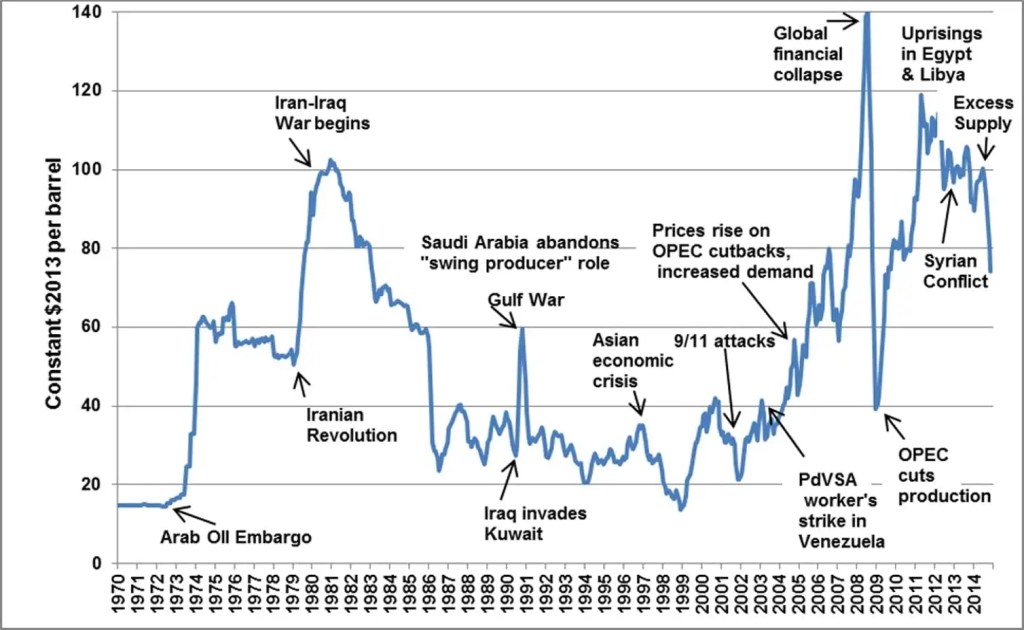

The chart below shows illustrative oil price spikes following major geopolitical conflicts. While each situation is unique, the pattern is consistent: conflict creates uncertainty, and markets price that risk quickly.

Historical examples:

- 1973 Yom Kippur War / Oil Embargo: Prices quadrupled as supply was restricted.

- 1979 Iranian Revolution & Iran-Iraq War: Oil doubled within a year.

- 1990 Gulf War: Brent and WTI roughly doubled as supply fears mounted.

- 2003 Iraq War & 2000s Oil Boom: Prices climbed from ~US$30 to ~US$147 as persistent Middle East risk and demand growth pushed energy markets higher.

- 2011 Arab Spring: Production disruptions pushed Brent above $100 a barrel.

- 2022 Russia-Ukraine War: Brent briefly rose above $120 amid sanctions and export restrictions.

A Venezuela-related escalation could follow a similar trajectory due to its strategic role in global energy markets.

2. Energy Prices and My Cost of Living

When oil prices rise:

- Petrol and public transport costs increase

- Electricity and heating bills rise

- Food and consumer goods become more expensive due to higher transportation and production costs

For my personal finances, this means less disposable income, even if my salary remains unchanged. Inflation driven by energy shocks is one of the hardest to offset because it affects essentials.

3. Market Volatility and Investment Impact

Past conflicts also show that markets tend to:

- React negatively in the short term

- Increase volatility across equities

- Push investors toward safe havens such as government bonds and gold

From my own investment perspective, this may result in:

- Temporary drawdowns in equity portfolios

- Underperformance in emerging markets

- Greater uncertainty around short-term returns

History reinforces the importance of not making emotional investment decisions during geopolitical shocks.

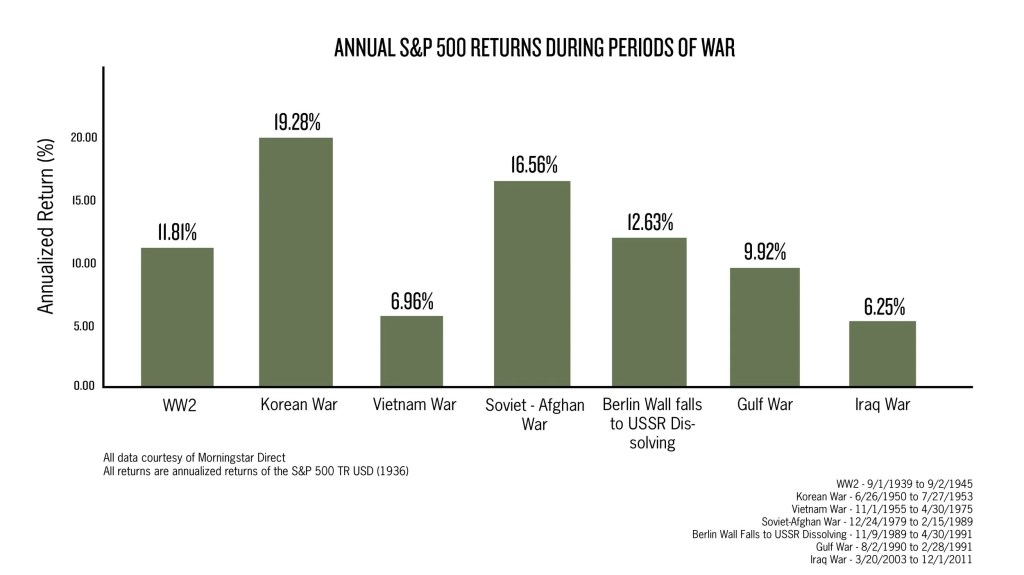

This chart illustrates how major stock indices reacted in the short term to past conflicts:

- Gulf War (1990): S&P 500 fell in early weeks but recovered over months.

- Iraq’s Invasion of Kuwait: Global equities saw meaningful short-term drops before rebounding.

- Russia-Ukraine (2022): Both S&P 500 and FTSE 100 experienced volatility and short-term declines before stabilising over subsequent months.

- Other conflicts: Data shows immediate shock impacts, while markets often recover once uncertainty subsides.

4. Pensions and Long-Term Savings: Lessons from Ukraine and Iraq

During the Ukraine war, many pension funds experienced short-term volatility but recovered over time. The same was true after the Iraq War and the Gulf War.

This highlights an important personal finance lesson:

- Long-term savings are designed to absorb geopolitical shocks

- Diversification across asset classes and regions is critical

- Short-term market noise should not derail long-term plans

A Venezuela-related crisis would likely test this resilience again.

5. Inflation, Currencies, and Purchasing Power

Energy-driven inflation following wars often leads to:

- Higher interest rates

- Reduced purchasing power

- Pressure on savings held in cash

Personally, this reinforces why I prioritise:

- Emergency savings

- Inflation-aware investment strategies

- Regular reviews of asset allocation

Conclusion: When Global Conflict Becomes Personal

History shows that wars—whether in the Middle East, Eastern Europe, or Latin America don’t stay confined to their borders. Through energy markets, inflation, and investment volatility, they reach directly into personal finances.

A potential Venezuela-related attack may feel distant, but its effects on fuel prices, living costs, pensions, and investments would be anything but. For me, the lesson is clear: financial resilience comes from diversification, discipline, and long-term thinking in an unpredictable world.