Most financial advice is boring. It tells you to eat less bread and save for a retirement that feels a lifetime away. Further, build an “emergency fund” because disaster might strike—your car might stop, your roof might leak, or you might get laid off.

That advice isn’t wrong as you do need that money, but framing savings purely as a defensive shield against disaster is uninspiring. It’s rooted in fear.

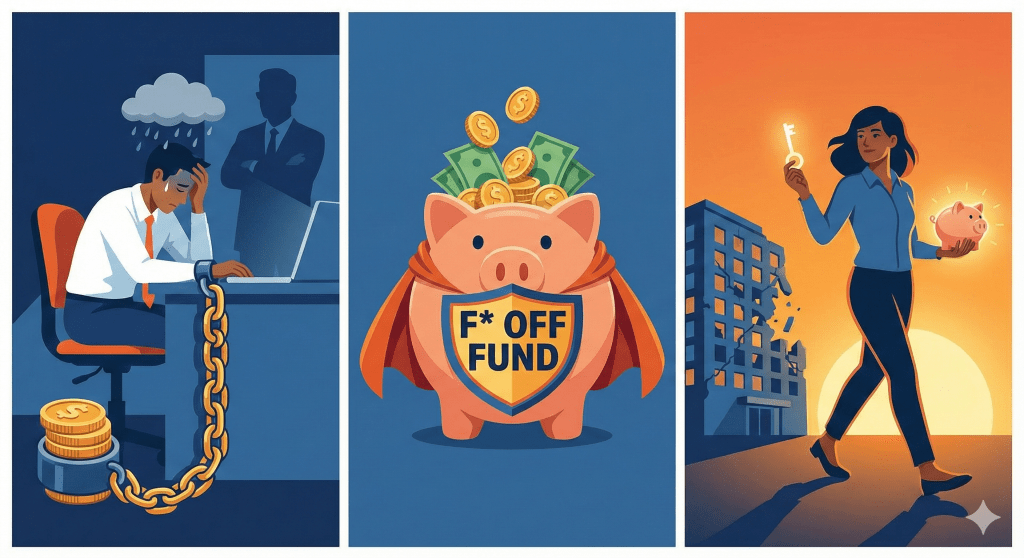

It’s time to rebrand the emergency fund. You don’t just need a safety net for when life happens to you. You need a war chest for when you need to take control of your life.

You need an “F* Off” Fund.

What is an “F* Off” Fund?

The concept, popularized in various forms over the years, is simple: It is a stash of cash large enough that if your boss, your landlord, or your partner crosses a line, you can look them in the eye and say, “I’m out.” It is not money for a vacation. It is not money for a down payment on a house. It is Freedom Capital. It is the price of your autonomy.

When you are living paycheck-to-paycheck, you are vulnerable. You have to tolerate the toxic manager who gaslights you because you need to make rent on the first. You stay in a relationship that has turned sour—or worse, abusive—because you can’t afford the deposit on a new apartment.

Debt and a lack of savings keep you trapped. An FOF is the key to the cage.

The Psychology of “Walking Away” Money

The magic of the FOF isn’t just in using it; it’s in knowing it’s there.

When you have three to six months of living expenses sitting in a bank account that only you control, your entire demeanor changes.

In the workplace: If your boss knows you are desperate, they own you. They know you will take the unpaid overtime and the disrespectful emails because you have no choice. But when you have an FOF, you walk taller. You negotiate harder for raises because you are not terrified of hearing “no.” You set boundaries. And if the environment becomes unbearable, you don’t have to line up a new job before you quit the old one. You have the breathing room to walk away and find something better. If you have enough savings, it improves your negotiation leverage.

In relationships & living situations: This is where the FOF is most vital. Financial dependence is one of the primary reasons people stay in unhealthy or abusive relationships. An FOF means you are never forced to sleep in a bed next to someone you despise, or live under a slumlord’s thumb, simply because you cannot afford a moving truck and a security deposit. It buys you safety. Financial dependence keeps people in abusive relationships.

Research shows that having a cash buffer (about $2,000 as a starting point) is a stronger predictor of financial well-being, than actual income level. It validates the idea that liquid cash provides a unique psychological safety net that investments do not.

How to Build Your War Chest

The mechanics of an FOF are the same as an emergency fund, but the motivation is vastly different.

1. Calculate Your “Escape Number” Forget your current lifestyle budget. What is the bare minimum it costs you to exist for a month? Rent, basic food, utilities, transport. Multiply that number by three. That is your starting goal. Six times is ultimate freedom.

2. It Must Be Liquid and Separate This money cannot be tied up in stocks, bonds, or retirement accounts where you face penalties to access it. It needs to be in cash, preferably in a High-Yield Savings Account. It should be separate from your checking account so you don’t accidentally spend it on pizza, but accessible within 24 hours if you need to bolt.

3. Start Rage-Saving Building this fund is daunting. If you can’t save $500 a month, save $50. The important thing is the habit. Every dollar you put into that account is a tiny piece of your freedom that you are buying back. When your boss annoys you, transfer $20 to the fund. Use that anger as fuel.

The concept of saving not to buy things, but to buy independence (autonomy), is a core theme in Housel’s best-selling book The Psychology of Money. He argues that the highest dividend money pays is control over your time.

The Ultimate Insurance Policy

Hopefully, you will never have to burn through your FOF in a dramatic exit. Hopefully, you will use it for boring things like a broken furnace years down the road.

But having that money turns a crisis into a mere inconvenience. And more importantly, having that money means that every day you show up to your job or your relationship, you are doing it because you choose to be there—not because you can’t afford to leave.