The world is well-versed of the detrimental effects of pollution on human life, from low birth rate to faster ageing to child growth failure, where pollution has spared no living organism on this planet. The World Bank estimates the global cost of health damages associated with air pollution at $8.1 trillion, equivalent to more than 6% of global GDP. But does rising pollution impact just health ? Think again ….

Earlier pollution was treated by economists as an “externality”—a side effect of industrial activity whose costs were borne by society rather than the company responsible. Today, that wall is crumbling.

Why pollution effects are not limited to just health

From the trading floors of New York to the boardrooms of Shanghai, pollution has mutated from an environmental concern into a quantifiable financial risk. As air, water, and soil pollution increase, investors, companies, and governments are being forced to respond to the economic risks that come with environmental damage.

Corporates located in cities with high pollution or ‘heavy emitters’ face higher costs of debt. Lenders now price in the risk of regulatory crackdowns and fines, often restricting access to financing for firms with poor environmental records.

How pollution affects an investor’s portfolio

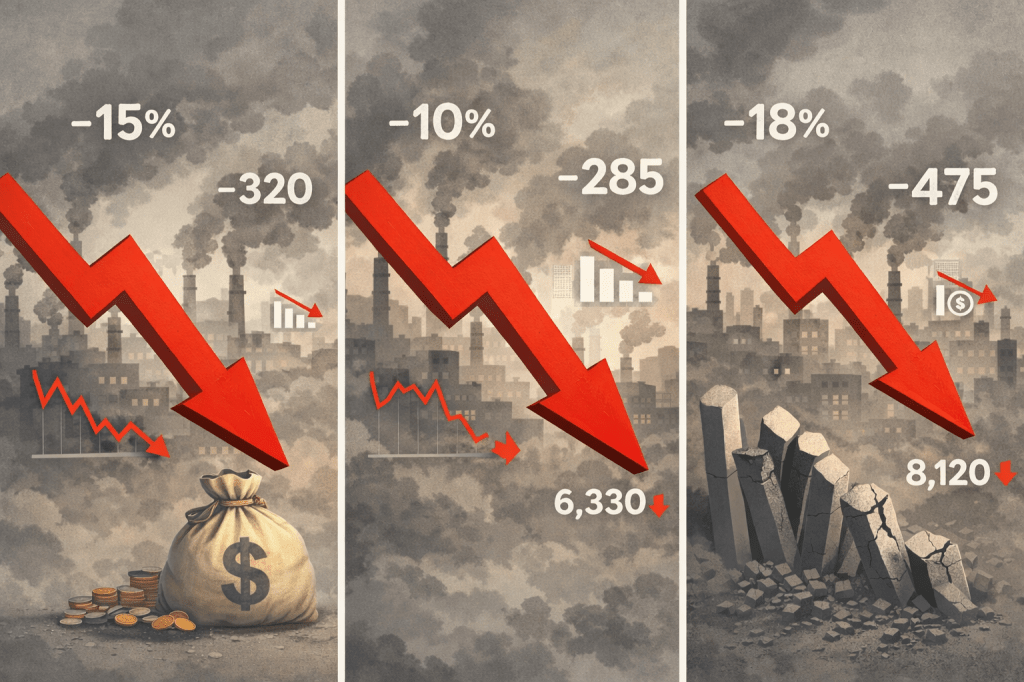

A company’s stock price is correlated to its costs, risks, and reputation. Corporates that pollute heavily are likely to face higher fines, taxes, or the need to invest in cleaner technology. These extra expenses can reduce profits, which often causes a company’s stock price to fall. Stricter environmental laws, carbon taxes, and emissions limits have raised operating costs for companies, especially in industries such as energy, manufacturing, and transportation.

For example, according to BP’s climate-related financial disclosures, changes in law and regulation, as well as shifting social attitudes, could have “adverse impacts” on its business by making it more likely to lose court cases and exposing it to greater environmental and legal liabilities. Legal proceedings “could reduce our financial liquidity and our credit ratings”.

Aviation, another industry with significant amount of greenhouse gas emissions has not been spared of the effects of its air pollution. Recent times have seen an increase in flight cancellations due to low visibility. For instance, severe bushfires in Australia, created heavy smoke and air pollution, disrupting domestic and international flights leading to a significant loss of revenue for the airlines. Furthermore, airlines have to incur additional expenses related to providing passenger support services for the operational disruptions. During major fire seasons, Qantas shares have experienced pressure due to cancellations, higher costs, and lower travel demand.

The Liability Link: Pollution is an Unpaid Debt

In the past, emitting pollution did not come at a cost. Today, stock markets view it as a “deferred liability”—a debt that will eventually come due.

Investors assume that governments will eventually tax or fine polluters. Therefore, a company with high emissions is seen as having a massive, invisible debt on its books. Markets are likely to lower the stock price today to account for these future costs. Additionally, companies with poor environmental records are statistically more likely to face expensive lawsuits or sudden shutdowns. To compensate for this risk, investors demand a higher return (lower stock price) to hold these shares.